In June 2019, the i2i Facility published three reports that explore the behavioural interventions which have proven to influence financial decisions. The first report provided an overview on Behavioural

interventions for financial services. It identified four focus areas with 23 related behavioural interventions for financial service providers.

As we explore how behavioural science can narrow the gap between customer intention and customer action, the other two reports have started to look at examples from specific financial services with a focus on Behavioural Interventions for Insurance and Behavioural Interventions for Remittances respectively.

These reports were prepared collaboratively with FSD Africa and form part of the insights being generated through our Risk, Remittances and Integrity Programme, which is a partnership between FSD Africa and Cenfri.

Below is an extract from the reports, highlighting key concepts, behavioural interventions and their application in financial services.

What is behavioural science?

Behavioural science is the scientific study of human actions. It seeks to understand the underlying factors that influence judgement and decision-making. These can relate to the individual or to the contextual environment. Someone living with very little income, for example, will find it more difficult to make long-term decisions around savings or accessing credit. Their constrained circumstances will force them to focus on their immediate needs.

Application of behavioral science to financial services

Financial service providers (FSPs) are increasingly seeking to translate new insights from behavioural science into the design and delivery of financial services. These insights have been mostly used by financial service providers to reduce the cost of acquiring new customers, improve the retention of existing customers and to achieve positive customer outcomes such as timely loan repayments. These FSPs use behavioural interventions to influence the financial decisions (or behavior) of potential customers or existing customers.

Types of behavioural interventions

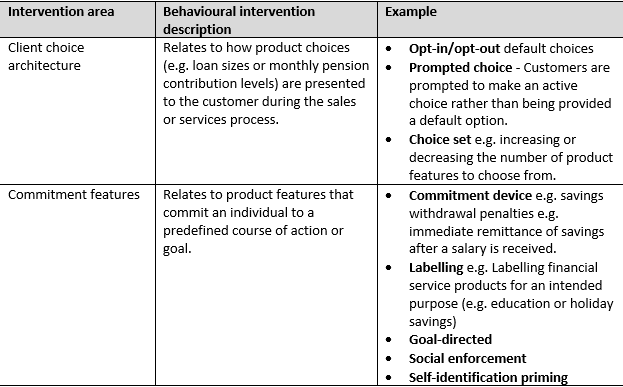

According to studies done globally by behavioural scientists in 2017 and 2018, there are 23 behaviour interventions for financial service providers with respect to the savings, credit, payment and insurance decisions of financial service customers. These interventions are categorized into 4 main intervention areas i.e. (i) client choice architecture, (ii) commitment features, (iii) pricing and financial benefits and (iv) client communications.

Client choice architecture refers to how product choices (e.g. loan sizes or monthly pension contribution levels) are presented to the customer during the sales or services process. Commitment features relate to product features that commit an individual to a predefined course of action or goal e.g. labelling as an intervention under this area refers to tagging services e.g. ‘Education or holiday savings. The first two intervention areas and interventions are as illustrated below:

More details on the intervention areas and interventions can be found in the report by the i2i Facility titled Behavioural Interventions for Financial

Services

Application in insurance

Insights from behavioural science can be used to inform the design and delivery of insurance products and increase uptake and retention of existing consumers.

Fourteen studies by 44 authors tested 10 interventions on insurance uptake and usage, across eight countries. Key findings based on the application of various interventions were as below:

Under the intervention area Client choice architecture, utilizing the choice set intervention

a) Among Mexican MFIs, the uptake of life insurance policies decreased by 30% when customers were asked to pay insurance premiums in an upfront lump-sum amount, as opposed to paying in weekly installments.

b) The number of cotton farmers in Burkina Faso buying weather index insurance increased by 15.5% when claim payments consisted of both a pay-out of the loss event and a rebate of the premiums paid to date. Farmers were willing to pay 10% more for the premium rebate policy than the traditional policy in which only a claims payment would be received if a loss were incurred

More key findings under the report by the i2i Facility titled Behavioural

Interventions for Insurance.

Application in remittances

Remittance providers are increasingly looking for innovative ways to increase formal remittance flows, in terms of number of customers and frequency and value of transactions. Behavioural interventions can be applied to reduce the cost of acquiring new customers, to improve retention of, and usage by, existing customers and to achieve positive customer outcomes.

Nine studies by 16 authors tested four interventions on remittance behaviour. The studies were conducted in three countries with senders from ten different countries. Key findings were as below:

Under the intervention area Commitment features, utilizing the labelling intervention:

a) Filipino migrants in Rome were willing to remit 15% more to family members in the Philippines when the transfer was labelled as being for educational purposes. When the label was enforced by sending the money directly to the school, Filipino migrants in Rome were willing to remit 17.2% more.

b) When given up to US$400 to remit, Salvadoran migrants in the United States remitted 16% more (US$35) when they had the option for the recipient to receive the funds in cash, as opposed to in grocery vouchers.

More key findings under the report by the i2i Facility titled Behavioural

Interventions for Remittances.