Our new report with the Coalition for Urban Transitions shows that investing in low-carbon cities across Africa offers promising opportunities to accelerate their transition to a green and resilient future.

Cities and governments that focus on key instruments and enabling policies will be well placed to unlock the required investment and stand to profit generously.

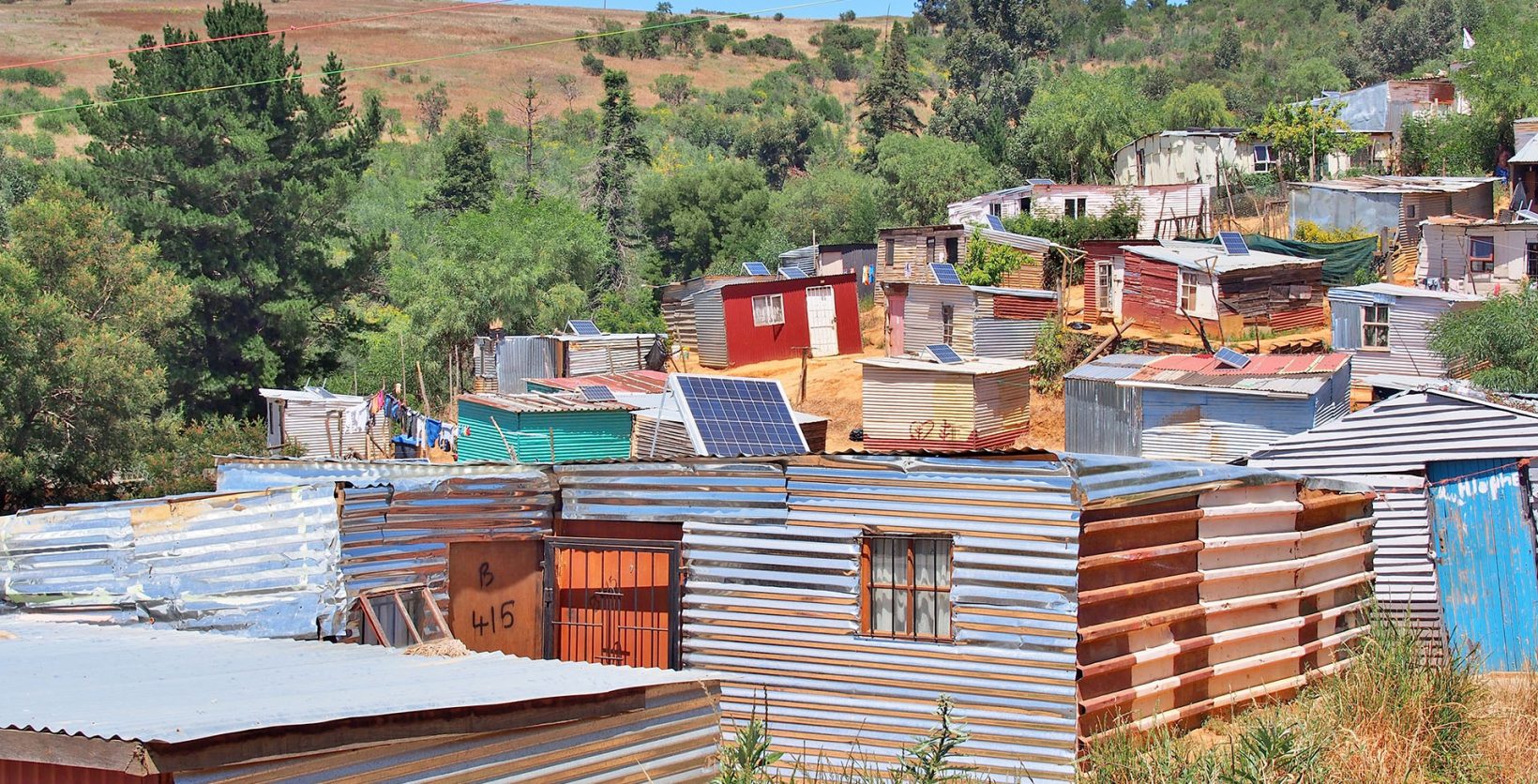

Africa is under immense pressure to develop its cities in ways that its people can thrive and their needs are met. Its cities are changing rapidly: urbanisation is happening faster than anywhere else in the world with populations set to double in the next 40 years. Lack of capacity to manage the growing demand for services means that poorly considered urban development is often sprawling, disconnected and polluting, putting considerable strain on already stretched societies.

Added to this, African cities face major threats from the impacts of climate change, with many of the continent’s key hubs and capital cities at extreme risk of flooding, droughts and heatwaves. Both challenges are compounded by the other.

The crises require a rapid and coordinated response to construct new climate-resilient places for city populations to live, work and travel. They present a major opportunity, described in this report, to rethink urban development by investing in compact cities with well-connecting services, efficient transport systems and protection from the risks posed by climate change.

Cities built this way will be more prosperous: they will be cheaper to run, healthier, less polluting and more inclusive. They will also create hundreds of thousands of jobs and provide attractive returns for investors.

The new report predicts that 35 major cities in Ethiopia, Kenya, and South Africa will benefit by $1.1 trillion by 2050 from investing in compact, connected and clean urban development – as much as 250% of their annual GDPs. The additional measures needed to build the sustainable cities will cost £280billion and generate generous returns with a net present value of $90billion in Ethiopia, $52billion in Kenya and $190billion in South Africa.

But it will require leadership and collective effort to unlock the green investment, with commitment from those in authority to overcome budgetary constraints and weak borrowing power. National policies and regulatory frameworks alongside initiatives to improve creditworthiness and implement land value capture will be required to help secure the funds.

City leaders can build on national policies by strengthening community participation and forging effective partnerships to harness the required expertise and local insight unique to each city.

The report shines a spotlight on the key instruments that urban leaders can pursue to unlock the vital investment. Cities in Africa and elsewhere are already piloting innovative mechanisms — pay-per-use cooling subscriptions and utility leasing contracts for electric buses — alongside established finance tools like green bonds and private sector partnerships, to draw in the capital and expertise needed to shape and finance Africa’s urban development.

“There is no ‘one-size-fits all’ approach to financing sustainable and resilient cities across Africa but this report shows how it is possible for national and city leaders to achieve ambitious goals by deploying scalable instruments to unlock urgently needed investment. With the right enabling environment, these instruments will help to secure the finance required to build attractive and resilient cities for Africa’s growing urban populations.”

Mark Napier, CEO of FSD Africa

African leaders that unleash their urban potential to support and finance low-carbon inclusive cities, will boost their economies, and build greater resilience to climate change, poverty, unemployment, and inequality. ‘Financing Africa’s Urban Opportunity’ is an enormous challenge but the possibility to accelerate resilience and prosperity is promising.